Cat nat insurance: Italian guidelines

Italy sets out the guidelines for compulsory cat nat insurance

Companies registered in Italy, (both commercial and industrial), including foreign branches and affiliates of multinational companies must purchase insurance coverage for natural disasters known as “CAT/NAT” (Natural Catastrophe) effective 31 March 2025.

Content and scope of the directive

The new directive establishes the rates, loss limits, exclusions, etc., which are based on the type and amount insured, for each individual insured on each of their Italian property insurance policies.

Insurers are obliged to review and modify local insurance contracts by 29 March 2025, beginning with those insurance policies which expire at the end of March 2025.

The objective of the directive is to issue modified insurance policies to include damages to buildings, machinery, equipment, land and all tangible assets of the insured where damages can be incurred due to natural disasters or catastrophic events, such as earthquakes, floods, landslides, etc., which can occur in Italy.

Application to foreign companies

This directive also applies to companies incorporated abroad who have a branch, subsidiary, or tangible insurable exposures in Italy. Refusal or evasion of this directive by insurers who do not adapt to that new directive, at the moment of their policy renewal dates, may be fined by IVASS (the Italian Supervisory Insurance Institute).

Main points of the directive

The main points of the directive are as follows:

- The new directive obliges foreign insurers who are authorized to operate in Italy, to follow and abide by the requirements of the Directive and includes those insurers who offer insurance coverage under “FOS – Freedom of Services” in Italy and are registered with IVASS. (see above).

- The premiums to be applied to these risks are defined on a risk analysis basis and shall be proportional to the insured risk in question. This evaluation will take into account the location of the risk, the vulnerability of the insured assets, and include claims statistics of the risk in question. Premiums are to be reviewed periodically taking into account the “anti-selection” of risks, and the solvency of local insurers.

- The new directive shall not cover damages caused by human error, armed conflicts, terrorism, sabotage, political risk, nuclear energy damage, and/or other standard exclusions currently indicated in local Italian insurance contracts.

In order for insurers to fulfil their obligations regarding this directive, underwriting guidelines need to be established with specific terms and conditions, deductibles, stop loss limits, etc. These guidelines will need to be reviewed annually against the insured’s entire risk exposure to territorial limits. Risk transfer tools, such as reinsurance, may need to be used depending on the necessary additional insurance capacity required to insure the client’s exposures under this directive.

When an insurer (domestic or foreign) has exhausted their capacity to underwrite the insured’s risks, IVASS (see above), must be informed immediately. IVASS must be informed by stating the fact of their lack of available capacity, on their website.

Application to European insurers

These rules shall also apply to all EU insurance companies authorized to operate in Italy who operate under the “FOS – Freedom of Services” directive.

If and when a foreign insurer decides to cease their activity in Italy, because they have exceeded their risk tolerance level, they are obliged to inform IVASS (see above) and the supervisory authority of their home country and to publish this information on their own company’s website.

Summary of subscription lines

Underwriting guidelines may be summarized as follows:

- For amounts insured up to EURO 1,000,000 loss limits must be equal to the amount (100%) of the insurance contract (15% deductible)

- For amounts insured from EURO 1,000,000 up to EURO 30,000,000 insurance contracts, insurance carriers must propose a minimum STOP LOSS limit of 70% of the amount insured (15% deductible)

- For larger exposures where amounts insured exceed EURO 30,000,000 and have over 500 employees, the definition of deductibles and loss limits under this directive are open for free negotiation by all parties involved

- In case the CAT/NAT coverages are already present in the current policy, the customer can update the policy to the new regulatory provisions at the first available deadline

Contractual transparency obliges insurers to supply adequate information for companies that are obligated to fulfil the CAT/NAT directive and must publish their pre-contractual documents and terms and conditions on their web sites, as per IVASS’s (see above) requirements.

What are the sanctions?

Those who do not comply with this obligation will not be able to access other forms of state aid.

These include, for example (the law does not expressly mention them), fundamental measures such as:

- the suspension of mortgages and taxes

- the extension of contribution payments

- access to the redundancy fund for employees

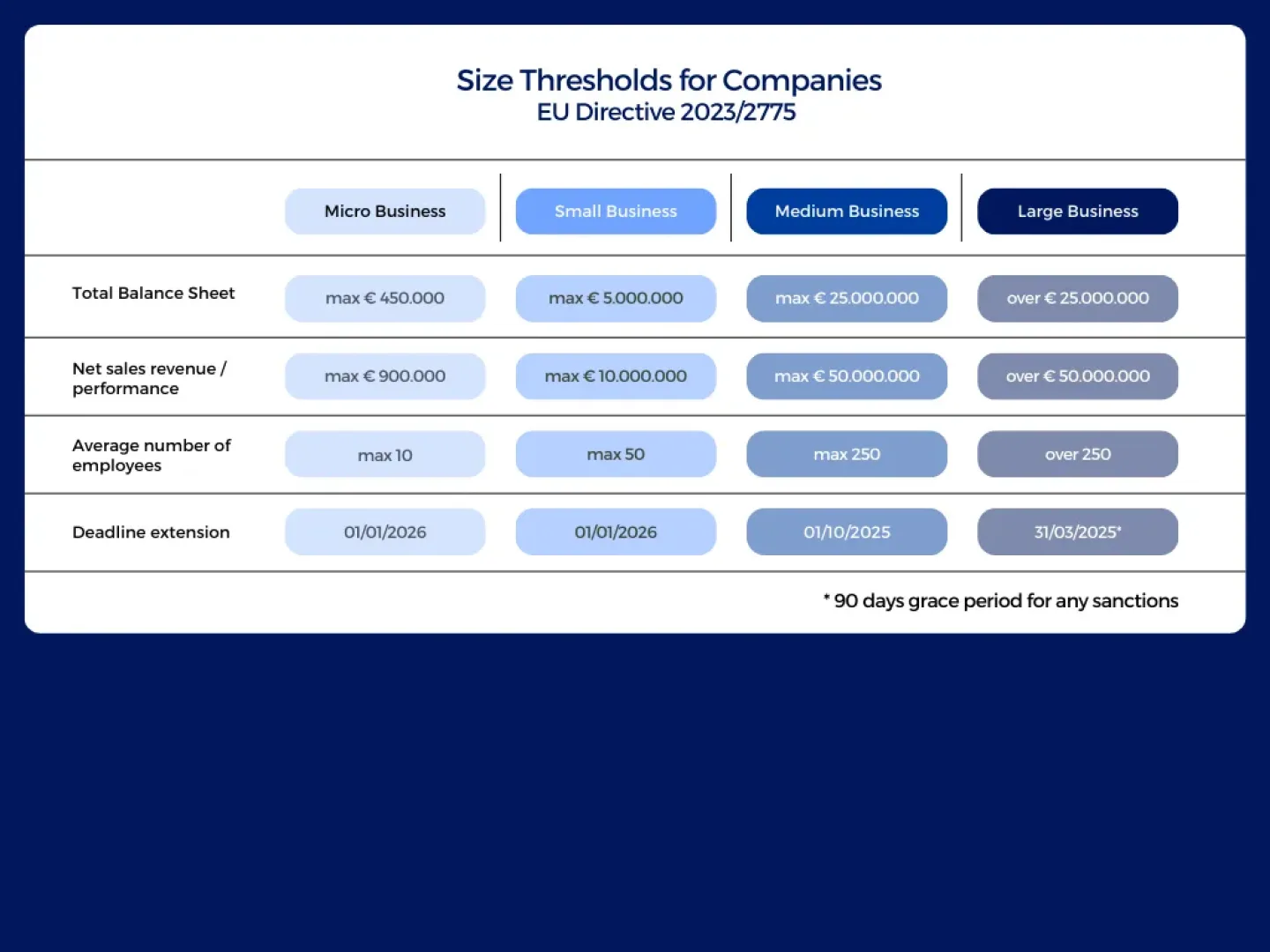

Shortly before 31/03/2025, the Italian Government extended the deadline for the entry into force of the law. For convenience, we have summarized everything in the following table: